Analysis of CLB’s labour data collected in 2023 shows that the post-pandemic economy has been disastrous for the manufacturing and construction industries, with workers out of jobs and owed wages and benefits. Many of these workers have flocked to the services industry, but consumer habits have changed, making this industry precarious, too. In this environment, companies across sectors are adapting to the economic changes in different ways, affecting workers’ rights and employment opportunities.

In this piece, CLB broadly analyses the raw data collected in our Strike Map and conducts a sector-by-sector analysis of issues affecting China’s workers and their labour rights:

- Manufacturing: Garment and electronics factories shut down or relocate while new energy vehicle companies compete for the market

- Construction: Widespread wage arrears after overproduction and stalled projects

- Transport and logistics: Platform workers fight back against price-cutting policies implemented to gain market share

- Services: Traditional retailers lay off workers, platform companies gain new market share

- Public sector: Sanitation, medical and education workers go unpaid as local governments are tight on funds

- Conclusion: Workers need representation and new tools in the face of widespread rights violations

Table of Contents

I. Broad trends

II. Sectoral analysis

A. Manufacturing

B. Construction

C. Transport and logistics

D. Services

E. Public sector

III. Conclusion

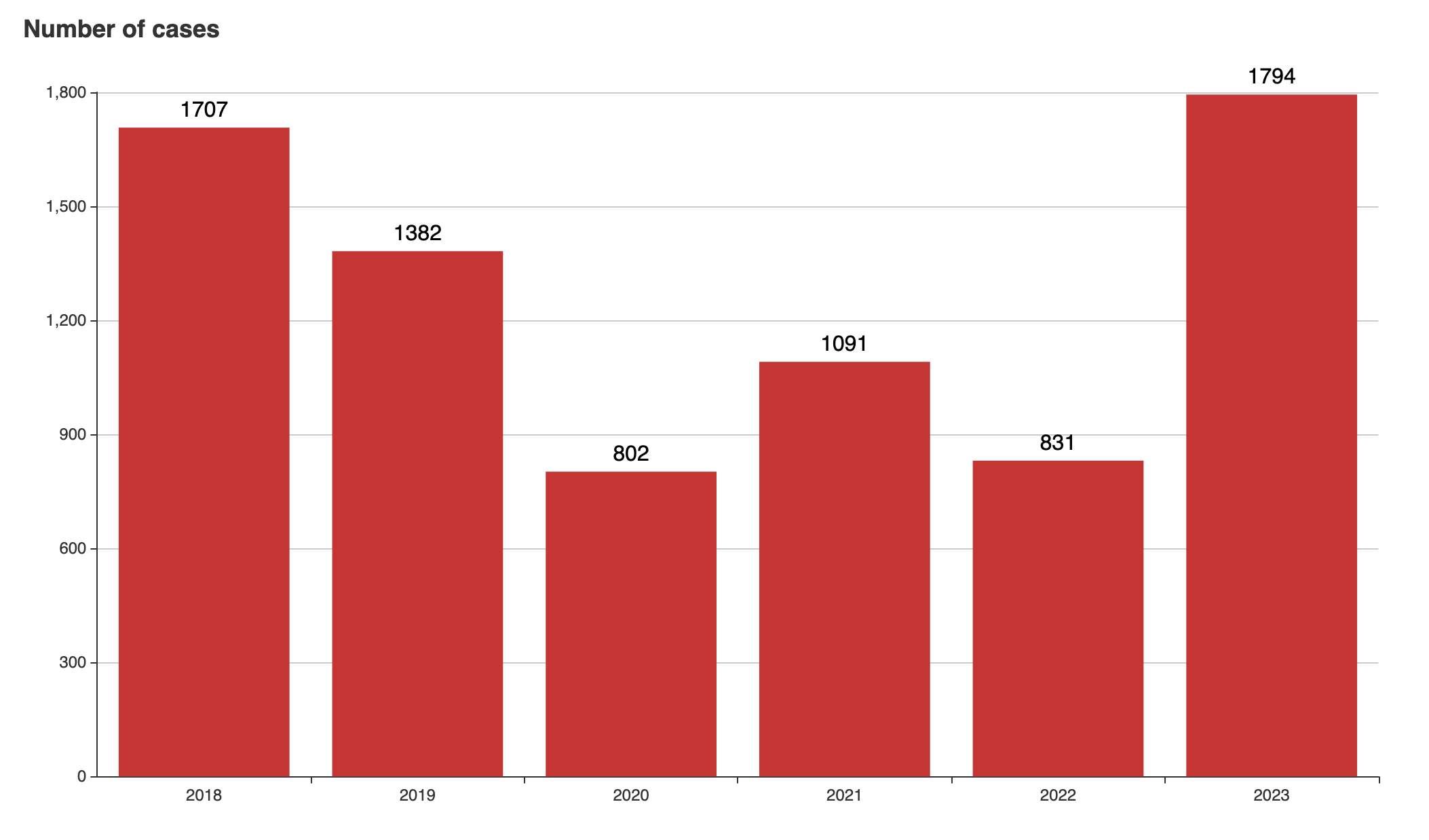

In 2023, China Labour Bulletin's Strike Map collected 1,794 incidents, more than double that of the 2022 total (831 incidents) and exceeding pre-pandemic levels of worker collective actions (see chart below).

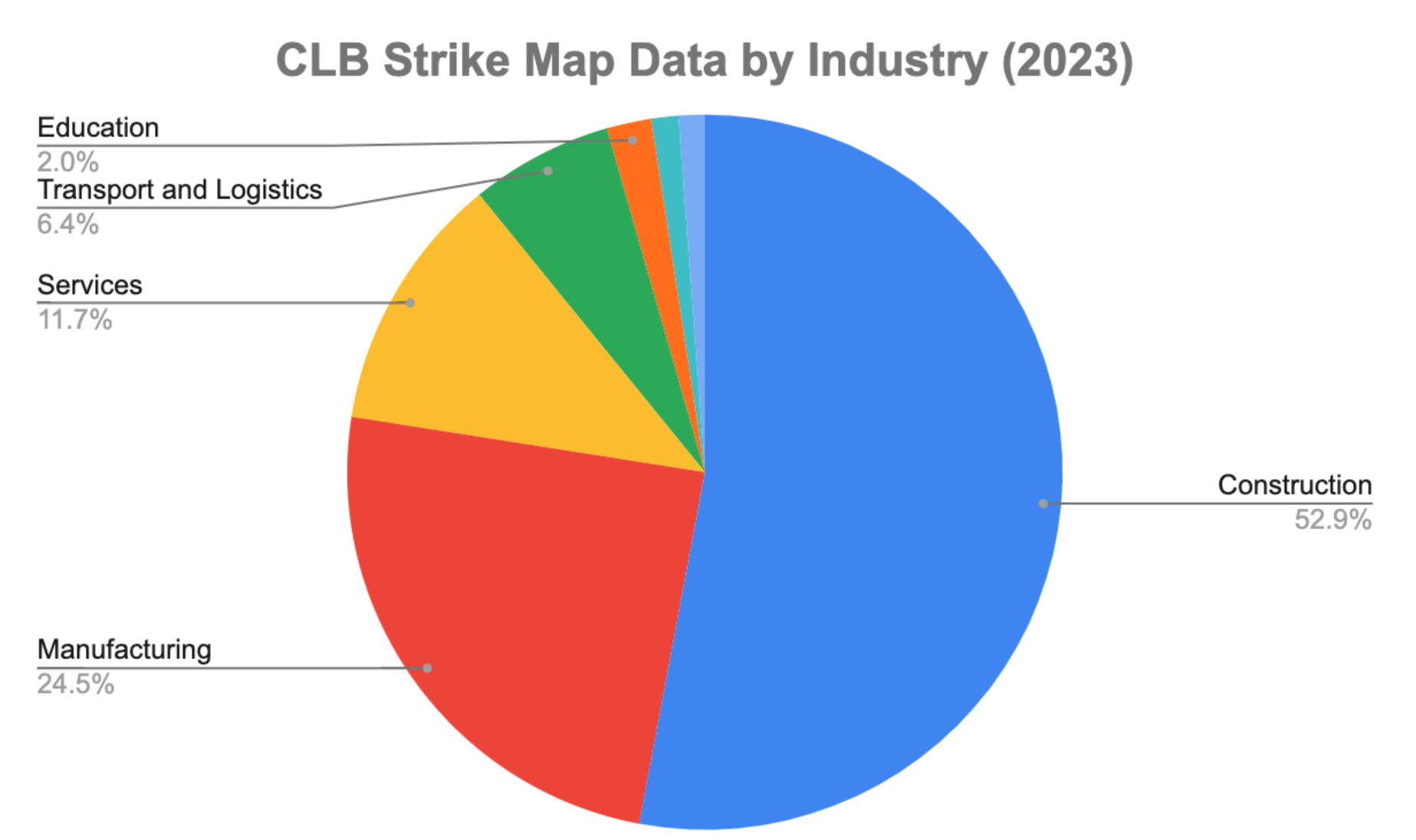

Among workers’ strikes and protests in 2023, those in the manufacturing industry increased tenfold year-on-year, reaching 438 incidents (24 percent). The construction industry again accounted for the largest proportion of incidents, with 945 (53 percent). The volume of incidents in other sectors also roughly tracked with recent years: The services sector logged 208 incidents (12 percent), followed by transport and logistics (115 incidents, 6 percent), education (36 incidents, 2 percent), and mining (22 incidents, 1 percent).

Chart: Number of CLB Strike Map incidents collected annually (2018-2023)

For more information about our data collection methodology and how to use our free and public map database, see our Strike Map User Guide

The abrupt end to China’s pandemic restrictions in late 2022 led to economic fluctuations. The manufacturing industry experienced a brief boom as production normalised, followed by a rebound at the beginning of 2023, and consumption in the catering industry also recovered. However, some major domestic industries have been in constant decline, and competition for capital has become more intense.

For example, starting in the spring, the coastal manufacturing industry shuffled, with reduced orders in the electronics and garment sectors. This change has caused widespread wage arrears, and closure and relocation of struggling factories. Meanwhile, competition in the electric vehicle market has intensified, but workers now face technological unemployment.

In addition, the downturn in the real estate industry continued throughout the year, and some major real estate companies are defaulting on their debt, exacerbating the contraction in construction and contributing to wage arrears in the industry.

The competition between e-commerce platforms and traditional retail has also continued, with supermarkets and hypermarkets rapidly closing branches and laying off workers while major platforms expand into the sector.

Photograph: B. Zhou / Shutterstock.com

The platform economy is oversaturated with workers. As platform companies cut prices and compete for market share, gig workers for online ride-hailing and freight platforms have faced difficulty making a living.

In this economic environment with narrower profit margins, companies are more likely to owe wages, social security and other legally-mandated benefits, and now more than ever are able to evade paying the required compensation for layoffs or business closure.

During the pandemic, some workers may have decided to cut their losses and find other employment under such rights violations, but CLB’s Strike Map has recorded increased protest and strike activity throughout 2023, showing that many workers have no other option but to try to defend their rights and hope for better economic conditions in 2024.

Manufacturing: Garment and electronics factories shut down or relocate while new energy vehicle companies compete for the market

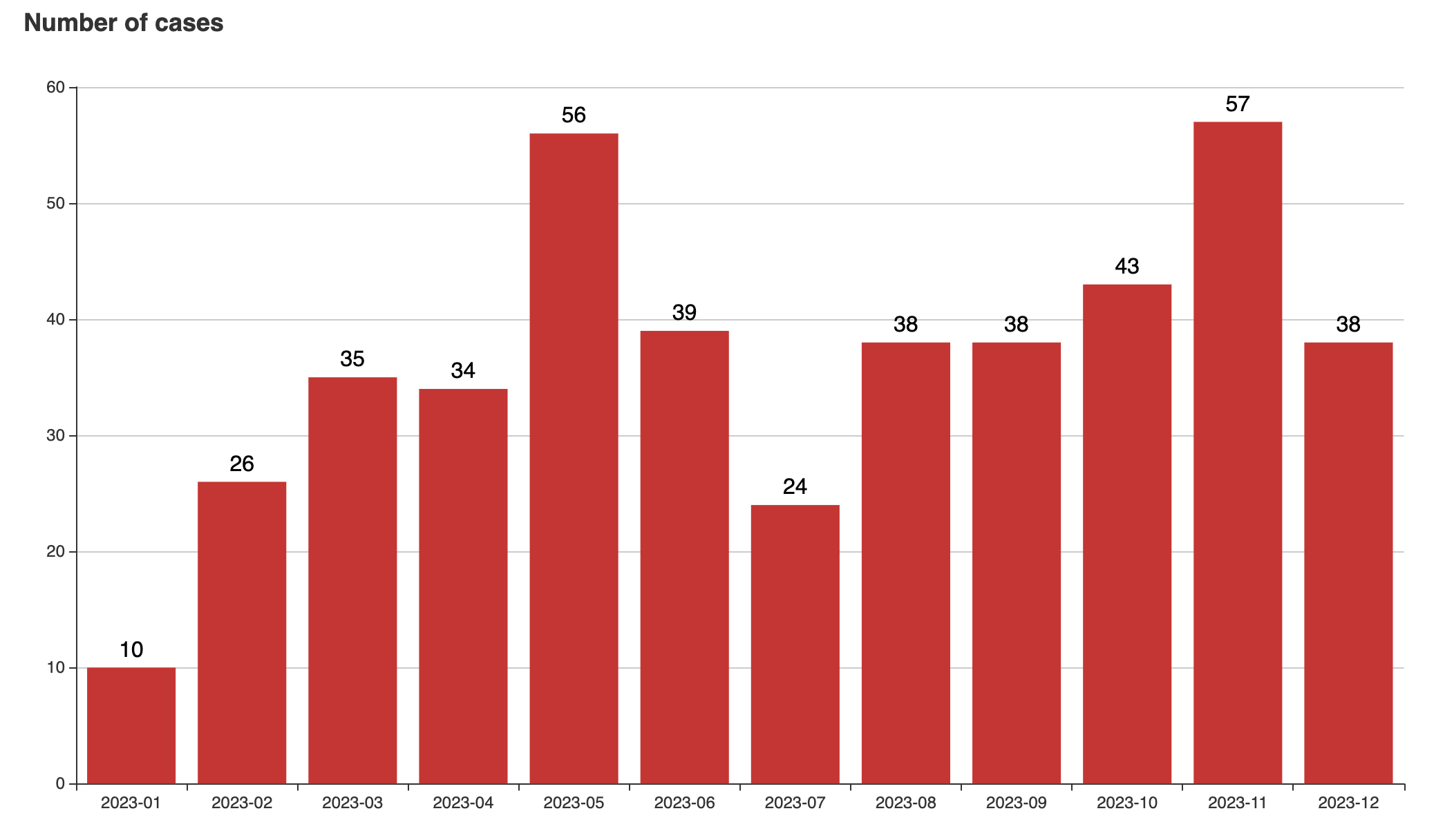

In the manufacturing industry, many coastal factories shut down or relocated inland in 2023. In January 2023, the Strike Map only recorded 10 incidents of factory workers’ strikes and protests, followed by 26 in February, and reaching an annual high of 57 in November.

Chart: Number of CLB Strike Map incidents in manufacturing sector, monthly (2023)

Geographically, factory workers’ strikes and protests expanded from China’s manufacturing hub of Guangdong province and out to Zhejiang, Jiangsu, Fujian and other provinces. There were also sporadic protests in inland provinces such as Jiangxi and Hunan.

Map: CLB Strike Map incidents in manufacturing sector by geography (2023)

In 2023, a total of 146 electronics factory protests were recorded in the CLB Strike Map, accounting for 33 percent of the manufacturing industry incidents. In the apparel sector, 94 protests accounted for about 21 percent.

The trend of supply chains moving to China’s inland areas and Southeast Asia for lower-cost production is not new, but 2023 was characterised by a faster pace of capital withdrawal. The changes in the production of integrated circuit boards are an example. These companies have moved en masse to Thailand and other regions to reduce trade risks and seize automotive electronics business opportunities.

The chairman of the Taiwan Circuit Board Association said in an interview that in the past three years, "no one wanted to go" to the association's inspection tours to northern Vietnam, Thailand, and Indonesia. But in November 2022, the association’s inspection tour to Thailand immediately filled its registration quota, and the chairpersons of some companies personally attended to facilitate immediate investment decisions.

CLB’s Strike Map picked up numerous cases of printed circuit board companies - concentrated in Guangzhou, Dongguan, and Shenzhen - shutting down or relocating. Workers were often not informed of the company’s plans, but workers picked up on signs and signals like moving equipment out of the factory or urging voluntary resignation. And when companies defaulted on wages or social security benefits, workers were prepared to go on strike. Some workers threatened to jump from buildings, and others sat outside the factory day and night to prevent the company from transferring assets as a way of avoiding paying workers their severance.

Apparel manufacturers were also affected by changing supply chains. Shrinking orders from international brands and relocation to cut costs were annual trends. In the past year, multinational clothing brands like Nike have focused on de-stocking to alleviate the impact of inflation and consumption contraction in Europe and the United States. Upstream manufacturers in China have borne the brunt of lost orders, and some factories accelerated their decisions to relocate or shut down.

Photograph: humphery / Shutterstock.com

In April 2023, workers at the Jiaxing Quang Viet factory in Zhejiang province went on strike over low wages after the Taiwan-owned garment factory made wage adjustments in light of worsening foreign trade. Another Taiwan-owned factory, Baoyi, producing shoes in Yangzhou, announced its closure in late November, and workers went on strike to demand a clear calculation of how their economic compensation would be paid. Baoyi workers had also been owed social security for some time.

At the same time that capital is withdrawing from China’s electronics and apparel manufacturing sectors, it is pouring into industries such as electric vehicles and renewable energy. The restructuring of capital has likewise shuffled workers.

During the pandemic, both traditional vehicle companies, such as GAC and SAIC, and internet technology companies, like Huawei and Xiaomi, have rushed to break into the automotive industry. This has caused the number of new energy vehicle positions on recruitment websites to surge by 200 percent in 2022. By 2023, overproduction brought an unprecedented wave of price cuts, spreading from new energy vehicles to fuel vehicles. In April, more than 40 vehicle brands and more than 100 models were on price reduction promotions.

In the solar energy industry, photovoltaics are also over capacity, but companies entering the industry have not stopped producing, and existing companies are expanding production in order to maintain market share. The ongoing price war has caused the price of photovoltaic modules to fall close to cost price in June 2023, while upstream silicon materials have plummeted by nearly 80 percent since the peak of the pandemic.

Factories in the photovoltaic industry also went out of business and owed wages. For example, JinkoSolar, which produces photovoltaic modules, and Jiangsong Technology, which produces automated photovoltaic cell production equipment, both saw workers protesting over wage demands at the end of 2023.

Photograph: helloabc / Shutterstock.com

The expansion of the new energy vehicle industry has caused long-time employees to face technological unemployment. Last year, traditional car companies reported preparing for mass layoffs and some planned to buy out employees over 45 years old. Many middle-aged employees were indeed laid off, and they entered a job market in which no one was hiring.

From the CLB Strike Map, we see that fierce competition continues to squeeze out companies with declining performance, affecting workers’ rights. Huajun Vehicles, a state-owned enterprise that produces fuel vehicles, collapsed, and hundreds of newly-unemployed workers rallied in front of the company in November to demand compensation.

Electric vehicle companies, too, have fallen into wage arrears, leading to worker protests. In February, workers hung banners at WM Motor, citing China’s Labour Contract Law and demanding economic compensation for their layoffs. In April, workers at Tianji Motors protested unpaid wages and social security, and in July, workers at Baoneng Motors protested wage arrears.

Construction: Widespread wage arrears after overproduction and stalled projects

Compared with the dynamic situation within China’s manufacturing industry, the slump in the construction industry only continues to worsen, and workers across the country have been protesting over owed wages. In 2023, China's real estate production shrank, development investment fell by nearly 10 percent compared with 2022, and new housing construction dropped by 20 percent. Floor area sold and enterprises’ development funds both decreased compared to last year.

On the other hand, sales in completed housing and commercial real estate are increasing, which reflects that after the explosion of the real estate market in the past decade, there has been a serious overproduction and the inventory is gradually being absorbed. The government's “three red lines” to regulate real estate companies’ rising debts during the pandemic - based on the “houses are for living in, not for speculation” policy - as well as the contraction in consumption during the pandemic, have further intensified the collapse of the real estate market.

The process of urbanization has slowed, and fixed-asset investments in road transportation and public facilities management decreased slightly in 2023. However, national infrastructure investment is still quite strong. Investment in railway transportation increased by 25 percent last year, and energy supply-related investment increased by 23 percent.

A total of 945 cases of wage demands were recorded among migrant workers in the construction industry last year, more than double the number in 2022. Among the incidents in which we can identify the type of project, residential project wage demands accounted for about 40 percent, shopping malls accounted for 18 percent, and infrastructure accounted for 10 percent. This proportion is similar to that recorded in 2022.

Country Garden, defaulted on its debt last year, had a total of 33 wage protests in the CLB Strike Map. For example, Country Garden's Emerald Era project in Weinan, Shaanxi province, defaulted on the wages of water and electric installation workers, and the workers only received about 60,000 yuan out of the 150,000 yuan owed. Seeking accountability, workers went to the building worksite to block the door, and then went to court to sue the subcontracting unit. However, the defendant blamed a third party, and workers never received their wages. Similar incidents have occurred across the country, and private real estate companies such as Evergrande, Vanke, and Sunac also have seen wage demands.

Photograph: Yaorusheng / Shutterstock.com

The contraction of the real estate industry has further reduced job opportunities for migrant workers, which especially affects older migrants. The companies they worked for in the past did not pay social security, and now other employers like factories are unwilling to hire those over 50. Many still feel the need to work, so they gather in labour markets. In some cities, older migrant workers compete with each other for jobs. As a result, daily wages are driven to extremely low levels. Workers who cannot get a job are left to work as construction handymen for only 80 yuan (U.S. $11) a day, and some sleep underneath overpasses or in unfinished buildings.

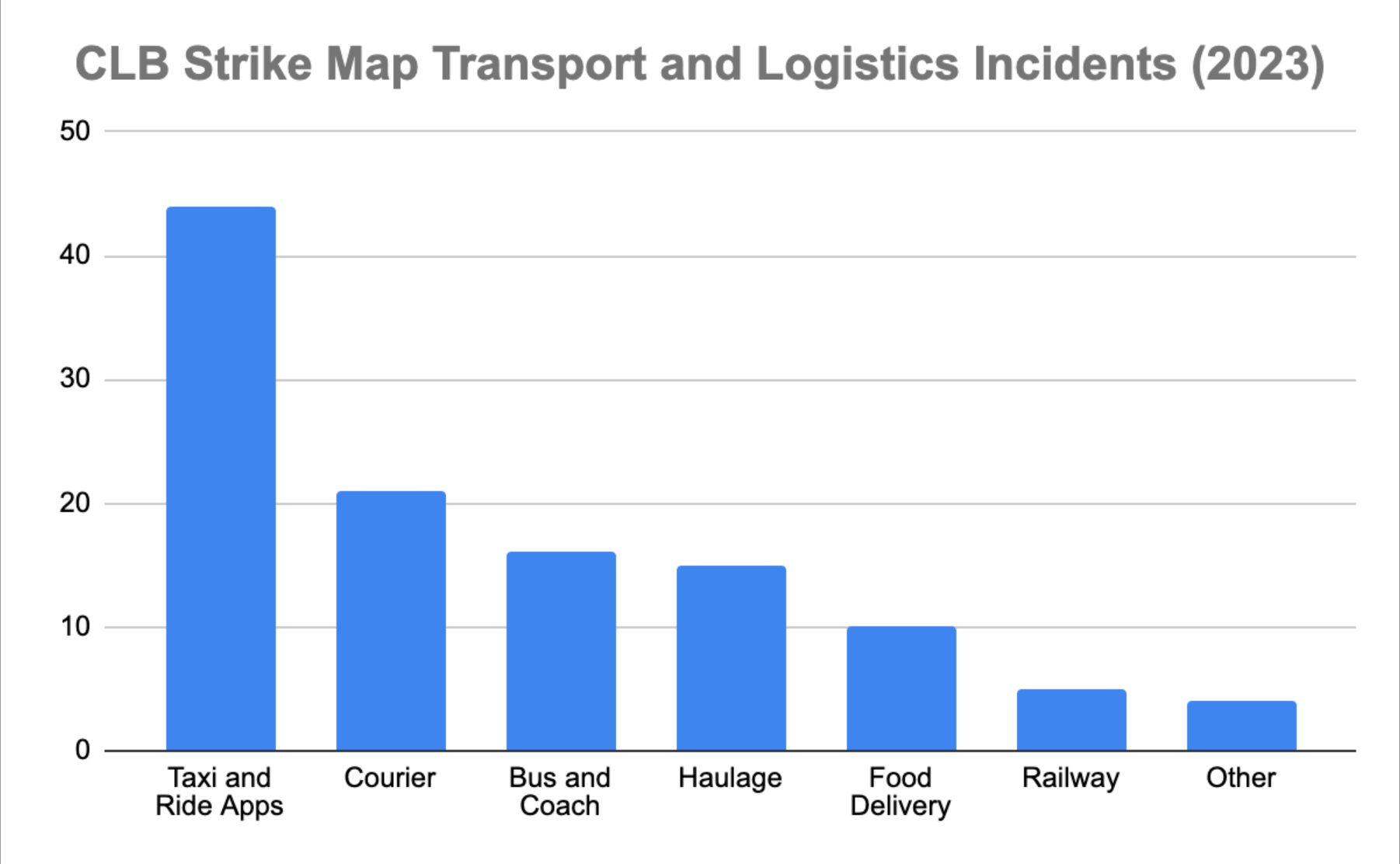

Transport and logistics: Platform workers fight back against price cutting policies implemented to gain market share

Unemployed workers from the manufacturing and construction industries are flocking to the transport and logistics industry, which is now oversaturated. Taking online ride-hailing as an example, The Paper estimated, based on data from the Ministry of Transport, that between 2022 and 2023, the online ride-hailing industry had an influx of 41 new platforms and 1.26 million drivers. Without a significant increase in demand, the industry has a surplus of drivers. This led to the transport bureaus of Shenzhen, Dongguan, Chongqing, Zhuhai and other places to issue risk warnings to prospective new drivers in the middle of last year.

The entry of new drivers and transportation companies has intensified the competition in the industry. A truck driver who has been working for 10 years said in an interview that because factories are producing less, it has become more difficult for drivers to find goods to transport, and shippers have taken advantage of this trend to further push down freight rates. This puts great pressure on drivers who have taken out loans to buy vehicles. They have no choice but to sleep in their vehicles. Some truck drivers want to sell their vehicles, but there are no buyers, either.

Platform freight companies have spotted the opportunity to lower unit prices to gain market share. In May 2023, drivers of the online freight platform Huolala (Lalamove) launched several strikes. Huolala drivers in Chengdu, Sichuan province; Chongqing; and Liaocheng, Shandong province, were dissatisfied that the platform reduced drivers’ incomes to attract customers. The platform also squeezed drivers' incomes by increasing membership fees and platform commission ratios. Five months after these changes, drivers in Foshan, Guangdong province; Hengyang, Hunan province; and Chengdu, Sichuan province, went on strike to protest against the platform’s change that made drivers bid against one another for lower-cost orders. For drivers, flexible pricing is a disguised wage reduction and intensifies competition among drivers.

The price war in the express delivery industry is still ongoing after several years. When interviewed, couriers said that delivery fees have dropped to a critical point, discouraging new couriers. However, poorly-managed express delivery outlets were shut down in 2022. Last year, there were slightly fewer protests over wage arrears at express delivery outlets, with 21 incidents (compared to 75 incidents in 2022). The once-hot investment and franchising wave of express delivery outlets has ended.

As for food delivery riders, their protests have increased, with a total of 10 incidents last year (compared to only one incident recorded in 2022). Three of the cases in 2023 involved workers demanding wage increases. Among them was a protest by Meituan delivery workers in Shanwei in late April, which received widespread attention. Continuous rain in Guangdong affected the working conditions and safety of delivery workers. However, Meituan not only cancelled many rider subsidies but also lowered unit prices and punished riders who did not report for work in bad weather, triggering a strike by riders. Meituan later dispatched a large number of out-of-town riders to fight the strike, instead of responding directly to the riders' concerns. After negative public opinions, Meituan restored unit prices and partially restored subsidies.

Services: Traditional retailers lay off workers, platform companies gain new market share

The contraction of major domestic industries, coupled with higher unemployment and under-employment, has changed consumption habits in China. One effect is the acceleration of e-commerce platforms outperforming traditional retail models, including hypermarkets. E-commerce has the benefit of self-operated logistics, and it poses a threat to large supermarkets in terms of convenience and price. The rise of community group buying, online delivery, and instant retail has also threatened the survival of brick and mortar hypermarkets.

Following the collapse of consumer electronics retailer Gome in 2022 and its arrears of wages and social security, the stores of both Carrefour (Suning) and BBK (Better Life Commercial) brands closed down one after another last year. In 2017, Carrefour had 259 stores in China, and Suning's annual report for the first half of 2023 shows that 106 Carrefour stores were closed in the first six months of last year, leaving only 41 stores across the country. The stores also suffered from product shortages, empty shelves, and limited consumption of stored-value cards in some areas. The supermarket department store business operated by BBK is also facing revenue decline and net loss. In 2022, a total of 139 stores were closed, and another 65 stores were closed in the first half of 2023.

Photograph: B. Zhou / Shutterstock.com

Affected by large-scale store closures, CLB’s Strike Map collected a total of 39 wage protests in the retail industry in 2023 (accounting for 17 percent of the service industry), of which Carrefour accounted for 9 cases and BBK accounted for 6 cases.

Traditional retail stores have partially withdrawn from the market, providing opportunities for new capital inflows. Major platform companies such as Pinduoduo, Meituan, Alibaba and JD.com, are constantly burning money to expand local retail distribution services during the pandemic. They use low-price strategies and their original logistics networks to seize portions of the market.

Community group buying is growing. However, with the collapse of some small and medium-sized community group buying companies, this money-burning period has come to an end. Starting from the second half of 2022, both Meituan and Duoduo Maicai have adjusted their directions, shifting from purely pursuing growth to pursuing gross profit. The commissions and rewards given to group leaders have both fallen sharply. The incomes of group leaders who are responsible for picking up goods and collecting commissions for group shopping will become increasingly difficult to maintain.

Public sector: Sanitation, medical and education workers go unpaid as local governments are tight on funds

Public services departments, including the sanitation and medical sectors, have wages owed to workers. This trend is related to the financial pressures on some local governments and public institutions. Of the 45 sanitation worker incidents collected in the CLB Strike Map, at least 16 were related to government funding issues. For example, in early February 2023, sanitation workers in Bazhou, Hebei province, protested against the Kangjie Company for delaying workers’ wages for nine months, on the grounds that the government did not pay the contract. These sanitation workers earn less than 1,400 yuan (U.S. $200) per month, but the workers decided to terminate their contracts after two months of working without pay.

Photograph: beersonic / Shutterstock.com

There were 14 protests in the medical industry over unpaid wages and social security, 10 of which were related to the performance of public institutions and state-owned enterprises. For example, on 3 November, medical staff at the Maternity and Child Health Hospital in Ruzhou, Henan province, gathered to demand wages. The Ruzhou municipal government responded, saying that due to various factors such as the decline in the birth rate and the impact of the pandemic, the hospital's income has dropped sharply, resulting in the inability to pay wages on time. The hospital was also listed in 2023 by three courts in Henan as responsible for paying an amount totalling about 10 million yuan. Other private maternity and gynecological hospitals, eye hospitals, and clinics have also been closed for rectification of wage arrears.

Some schools also have sporadic wage arrears, with more than 30 incidents in the education sector in 2023. These teachers who protest against unpaid wages are usually in inland cities. For example, in mid-May, 34 school teachers in Sanmenxia, Henan province, issued a statement on their hunger strike to protest that for four years since they qualified as state teachers, they have not signed labour contracts and are owed wages and social security. They have complained many times to their supervisor, with no resolution. Their action is considered mild compared to workers' wage demands in other industries. The teachers’ statement points out that they have used "the most humble way” to petition the education bureau, they did not name the school at which they work, and they said they apologise to the school, parents, and society.

Conclusion: Workers need representation and new tools in the face of widespread rights violations

In 2023, CLB’s Strike Map captured the portraits of workers protesting and striking over labour rights issues, reflecting the capital flight and turbulent economic recession in post-pandemic China. Some companies have quickly withdrawn from industries with declining profit margins and rising risks. Others continue to invest funds in new business opportunities to seize the moment; but once they have established competitive advantages, they will cut prices and affect workers’ livelihoods. During an industry collapse, companies leave and workers have to compete for the remaining jobs.

Some workers first try to avoid the impact of the economic recession, and we see this in the high number of applicants for the national civil service examination, teaching qualifications, and postgraduate entrance examinations. The high youth unemployment rate has led more university students to accept unemployment, or seek part-time jobs and other means to make ends meet. As for those workers who were directly laid off and whose benefits were reduced, many more launched strikes and protests.

Under such circumstances, China’s workers need trade unions that can represent them before and after rights are violated. Such a mechanism, functioning properly, would support the country’s economic and social goals by ensuring both public and private rights are protected, and citizens can have a fair chance at earning a decent livelihood.

As workers are fighting for their rights, and CLB has long advocated for China’s official trade union to take up its mandate to represent workers, we still recognise that new tools and strategies are needed to support the workers’ movement in China. In 2023, CLB began to seek engagement with actors along the supply chain in the midst of dramatic changes to China’s manufacturing industry.

The reality is that these supply chain changes and practices broadly affect workers in the Global South, each according to their own country conditions. The fate of China’s workers is linked to those in the region, and to brands, consumers, and the economies of the Global North. CLB urges for international solidarity with workers taking a stand in China, just as we stand with workers in the region fighting for their rights.

Further CLB reading:

- An introduction to China Labour Bulletin’s Strike Map (last updated January 2024)

- China Labour Bulletin Strike Map data analysis: 2022 year in review for workers' rights (January 2023)

- What You Need to Know About Workers in China: Workers’ rights and labour relations (last updated July 2023)