Introduction

The two-week strike by around 40,000 workers at the Yue Yuen shoe factory in Dongguan in April 2014 was a watershed moment in Chinese labour relations. Not only was it the largest strike in recent history, it, crucially, highlighted the numerous problems endemic in China’s social security system.The strike was triggered when workers discovered that the company had been underpaying social insurance contributions for years on end, leaving thousands of employees, who had spent much of their working lives at the company, with a much smaller pension than they were entitled to. In some respects, the Yue Yuen workers were lucky to have any kind of pension: Despite government attempts to increase pension and other social insurance coverage, the majority of workers still lack an effective social welfare safety net, and, as the workforce gets older, strikes and protests over the failure of employers to pay social insurance have now become a regular occurrence across China.

The problems in China’s social security system can be traced back to two key events: The break-up of the state-run economy, which had provided urban workers with an “iron rice bowl” (employment, housing, healthcare and pension), and the introduction of the one-child policy in the 1980s, which meant that parents could no longer rely on a large extended family to look after them in their old age. In other words, as the economy developed and liberalized in the 1990s and 2000s, both the state and social structures that had supported workers in their old age, ill-health and during times of economic hardship gradually vanished, leaving a huge vacuum to fill.

The Chinese government sought to create a new social security system based on individual employment contracts that would make employers, rather than the state, primarily responsible for contributions to pensions, unemployment, medical, work-related injury and maternity insurance. In addition, the government established a housing fund designed to help employees, who no longer had housing provided for them, buy their own home.

The new system emerged piecemeal through a series of specific regulations and provisions in the 1994 Labour Law (劳动法) and 2008 Labour Contract Law (劳动合同法) etc. It was not until 2011, however, that these separate parts were codified into a comprehensive national framework in the Social Insurance Law (社会保险法). The basic principles of China's social security system, as outlined in the Social Insurance Law, are as follows:

- All employees, including rural migrant workers, should be covered by the social insurance system.

- Both employers and employees are required to make contributions (at different rates) to a pension fund, unemployment insurance fund and medical insurance fund, as well as the Housing Provident Fund. Employers, but not employees, are also required to contribute to the work-related injury and maternity insurance funds.

- The various insurance funds are managed by local governments and are pooled into provincial or municipal funds. Usually it is the local labour or human resources and social insurance departments that manage the social insurance funds, while the Housing Provident Fund is managed by the local government’s Housing Provident Fund Management Committee.

- The funds collected must only be used for the specific purpose intended, namely the provision of social insurance for workers and retirees.

- The pension and medical insurance funds are composed of pooled components, which can be used to benefit any eligible employee, and personal accounts that benefit the individual employee concerned, when they become eligible.

- Social insurance benefits should remain with workers when they move. However this provision has proved very difficult to implement because of the highly localized nature of the social welfare system in China. Getting different jurisdictions to share information is fraught with bureaucratic and technical difficulties, especially for workers coming from rural areas of China.

In general, as with nearly all labour legislation in China, enforcement of the Social Insurance Law, even its most basic provisions, has been very lax, and the majority of workers are still denied the social security benefits they are legally entitled to. The government has sought to resolve this issue, not by enforcing the law, but rather by introducing new insurance schemes based on individual contributions from urban and rural residents, and by seeking to encourage compliance of the Social Insurance Law by gradually reducing the contributions employers and employees have to make to the various insurance funds. It seems that the government has to some extent accepted that it has failed to create an effective employee-based social insurance system and is now moving towards a system that relies more on individual contributions, essentially letting employers off the hook.

Job seekers outside a recruitment office in Dongguan

There follows a detailed look at each component of China’s current social security system and the particular problems and challenges for each of those components. In addition, we look at the specific problems encountered by rural migrant workers in getting their legally mandated welfare benefits, and assess the future development of the system.

Pensions

The basic framework for China’s pension system was set up in 1997 under the State Council Decision on the Establishment of a Unified Basic Pension System for Enterprise Workers (国务院关于建立统一的企业职工基本养老保险制度的决定). Both employees and employers are required to make contributions to the pension system. Workers contribute based on their individual wage, at a rate of up to eight percent, while employers contribute a percentage of the total wages paid to their workforce, usually around 20 percent. There is a cap on contributions for both employers and employees and exact contribution rates vary from region to region. In mid-2016, several provinces and cities, including Beijing, started to reduce employer contributions by one percent from 20 percent to 19 percent, and some regions such as Guangdong later reduced rates to as low as 14 percent. In 2019, Premier Li Keqiang formally announced in his work report to the National People’s Congress that employer contribution rates in all regions could be reduced to 16 percent, as part of a package of measures designed to relieve the tax burden on businesses.

Workers’ contributions are paid into a personal account. On retirement, the balance of the account, including interest, is divided into 120 instalments to be paid out monthly over a ten-year period. In addition to the benefits paid out from the personal account, the worker also receives general pension payments, payable until death. The general pension payments are determined by the number of years of employment, the average wage in the locality, and life expectancy. These general pension payments are ostensibly funded by the employer’s contributions, but the government is legally obligated to cover any shortfalls.

Workers become eligible for pension benefits when they reach the statutory retirement age but only if they have participated in the scheme for at least 15 years. Those who have participated for less than 15 years may delay retirement until they have contributed for 15 years, pay the remaining required contributions, transfer their pension plan to a plan for non-employed rural or urban residents, or receive the entirety of their individual account, including interest, in a lump sum payment.

For decades in China, there was a separate pension system for civil servants and other government employees such as teachers, who did not need to pay their own pension contributions and were entitled to a generous government-subsidized pension on retirement. However, in January 2015, the State Council in its Decision on the Reform of the State Employee Pension System (国务院关于机关事业单位工作人员养老保险制度改革的决定) introduced a new pension plan designed to equalize the private and public-sector systems. Under the new scheme, public sector employees have to make their own contributions to the pension fund. However, the authorities have stated that the basic salaries and pension benefits of civil servants and employees of public institutions will be augmented accordingly to offset any financial losses for employees under the new system.

One of the biggest problems with the current pension system in China is the statutory retirement age; 60-years-old for men and 50-years-old for women workers in enterprises, 55-years-old for women civil servants. These limits were established in the 1950s and are clearly no longer realistic in a country where the average life-expectancy is now 75 years and more than ten percent of the population are already over 65-years-old. The Chinese government has long acknowledged this problem and officials have announced various plans to gradually increase China’s statutory retirement age. In March 2018, for example, the vice minister of Ministry of Human Resources and Social Security, Tang Tao, said the government’s aim was to raise the retirement age for women by one year every three years while the retirement age for men would increase by one year every six years, so that by 2045, the retirement age for both men and women would be 65. However, up until now there still are no definitive regulations in place on raising the retirement age.

Despite the declining workforce and rapidly aging population, according to official statistics, basic urban pension fund revenue currently still exceeds expenditure in most provinces, particularly in coastal provinces like Guangdong, which had a yearly surplus of 155.9 billion yuan and an overall balance at the end of 2017 of 924.5 billion yuan. However, provinces in the northeast of China that have an excess of retirees and a shortage of young people are already feeling the strain. In Heilongjiang, for example, pension pay-outs exceeded revenue by 29.4 billion yuan in 2017, with the overall account balance standing at minus 48.6 billion yuan, according to the National Bureau of Statistics.

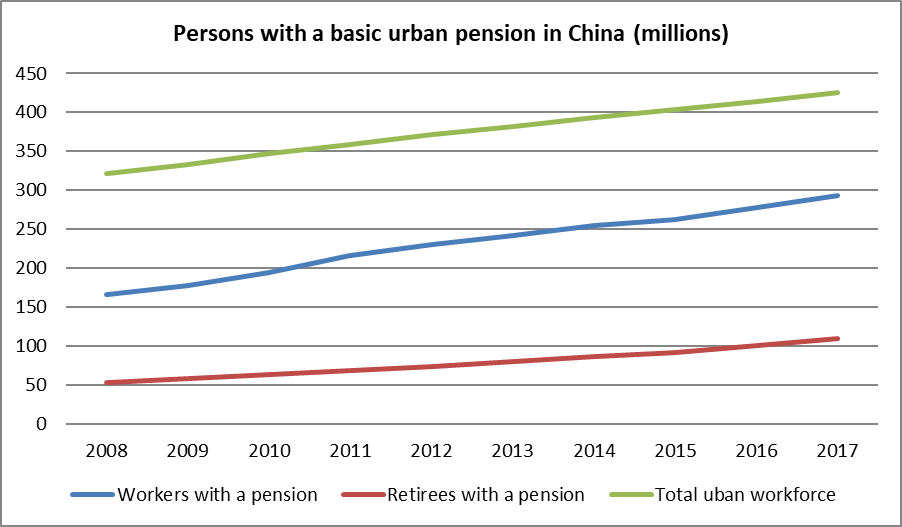

Official figures show that there were 293 million workers in China contributing to the basic urban pension plan in 2017. This represented about 69 percent of the total urban workforce of 425 million. The proportion of urban workers contributing to the basic pension scheme has increased gradually over the last decade but there is clearly still a long way to go. (See the graph below). In China as a whole, there were 357 million full-time employees contributing to rural and urban basic pension plans, or only about 44 percent of China’s total workforce of 807 million.

Source: China National Statistical Yearbook and MOHRSS

To supplement this shortfall, the government has been promoting a basic pension for urban and rural residents who are not necessarily formally employed. This scheme requires residents to pay contributions into an individual account for at least 15 years before becoming eligible for a pension on retirement. The fund is subsidized by the government but monthly pay-outs, especially in rural areas, are generally very low. Indeed, official figures show that the average pay-out for the 156 million people receiving benefits in 2017 was just 1,520 yuan for the whole year. The average annual pay-out from the basic urban pension fund by contrast was 34, 498 yuan. The individual residents’ scheme has the potential to grow and provide more extensive benefits in the future but it currently has little real impact.

Unemployment insurance

The State Council’s 1999 Regulations on Unemployment Insurance (失业保险条例) established a framework for contributions to and payment of unemployment insurance that was largely affirmed by the Social Insurance Law. Both workers and their employers pay into the unemployment insurance system, originally at rates of one and two percent respectively, however many provincial and municipal governments have now substantially cut contribution rates as a means of reducing costs for businesses. In Guangzhou, for example, the employer rate dropped from 1.5 percent to 0.8 percent and the employee rate was cut from 0.5 to 0.2 percent effective 1 May 2016.

At the end of 2017, 188 million workers, including 49 million rural migrant workers, had unemployment insurance. Those covered are eligible for benefits, including continuation of medical insurance, in the event that they become unemployed. The duration of benefits depends on the length of time the employee has paid into the system, with a maximum of 24 months of benefits for those who have been employed for ten years or more. However, just over two million workers actually received unemployment benefit in 2017, out of a registered unemployed urban population of 9.7 million, according to official statistics.

Although employee contributions are based on salary, the benefits paid out are very low. The 1999 Regulations state that unemployment benefits must be lower than the local minimum wage, which is already set at a very low level and can in no way be considered a living wage. See section on Wages and Employment. Although the Social Insurance Law stresses that unemployment benefits are transferable and can be claimed in any location, structural reforms will be necessary for such a policy to become a reality, especially in rural areas that currently do not have a system for disbursing urban unemployment benefits. At present, many local authorities address the issue by providing migrant workers with a one-time payment amounting to much less than they are legally entitled to.

In reality, unemployment insurance funds are often reassigned for job creation or job training projects rather than paid to workers directly. In 2019, for example, the government has pledged to “allocate 100 billion yuan from the surplus in unemployment insurance funds to provide training for over 15 million people upgrading their skills or switching jobs or industries.”

Medical insurance

The framework for China’s employee medical insurance system was first set out in the 1998 State Council Decision on the Establishment of a Basic Medical Insurance System for Urban Staff and Workers (国务院关于建立城镇职工基本医疗保险制度的决定). Both workers and employers are required to make payments to the basic medical insurance scheme which, like the pension scheme, combines an individual account with pooled funds. Though the amounts vary from region to region, workers typically contribute two percent of their individual wages - all of which goes directly to their individual account - while employers usually contribute between six and 12 percent of their workforce’s salary, a proportion of which (usually 30 percent) goes into the workers’ individual accounts while the remainder goes to the public fund. Once the worker has paid into the system for the requisite number of years, they are eligible for benefits without having to make additional contributions.

The worker’s individual account is supposed to cover the cost of any medical treatment that amounts to ten percent or less of the local average annual wage. The pooled insurance funds cover any costs above ten percent of the average annual wage, capped at five times the average annual wage. If an employee does not have sufficient funds in their individual account to cover ten percent of the average annual wage, they have to make up the shortfall out of their own pocket. It can take low-paid employees several years to reach the ten percent threshold and as such many insured workers still end up paying for their own minor treatments regardless. Likewise, at the other end of the scale, employees have to pay for any medical expenses in excess of five times the average wage.

The Social Insurance Law stresses that the medical insurance fund should cover workers’ medical costs by paying service providers (usually hospitals and clinics) directly. However, in most cases, workers have to pay up-front and request reimbursement from the authorities later. Moreover, to be eligible for public insurance funds, hospital treatments must be on a pre-approved government list - treatments outside of the pre-approved list must be paid out of either the worker’s individual account or their own pocket. Coverage for outpatient treatment and medicines is even more limited. This means that people who need outpatient treatment and medicine often have to buy additional private medical insurance, pay for treatment out of their own pocket or forego treatment altogether.

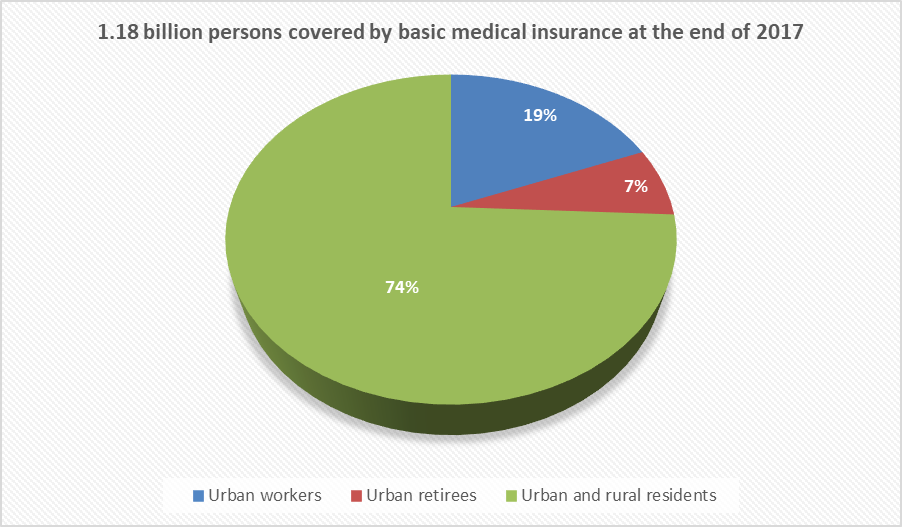

The number of workers and retirees covered by the urban basic medical insurance scheme has increased steadily over the last decade but by the end of 2017, there were still only 223 million urban workers were covered, along with 80 million retirees. Moreover, the number of rural migrant workers with basic medical insurance in 2017 was estimated at just 62 million, or about 22 percent of the total migrant worker population. By contrast, the number of rural and urban residents who are covered by medical insurance that is not tied directly to employment, mainly the self-employed, casual workers, non-working spouses, the elderly and children, has increased much more rapidly to the point where at the end of 2017 there were 874 million people paying into basic medical insurance schemes for residents (城乡居民基本医疗保险), or nearly three times the number of urban workers and retirees with medical insurance combined.

The Urban Resident Basic Medical Insurance Scheme was introduced in 2007 and aims cover the majority of inpatient medical costs for participants, is based on individual contributions together with local and central government subsidies. A similar program, the New Rural Cooperative Medical Scheme (新型农村合作医疗) operates in rural areas and individual contributions are usually set at a very low level. However, the vast majority of rural residents will still have to travel to major cities for treatment in serious cases because of a lack of high-quality medical facilities in their home area.

Work-related injury insurance

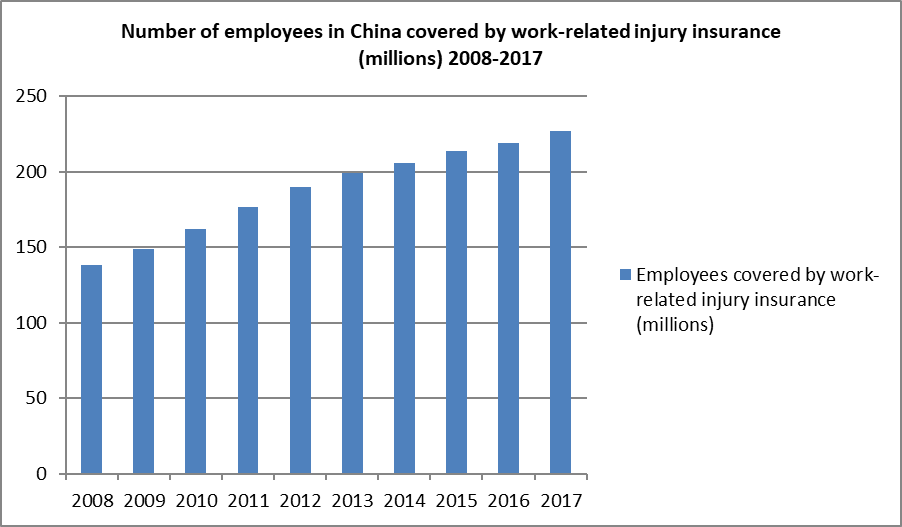

As with other forms of social insurance, work-related injury insurance coverage has increased steadily over the last decade, according to official statistics – see chart below. By the end of 2017, there were 227 million workers with work-related injury insurance, including an estimated 78 million migrant workers. Within China’s most dangerous industry, construction, more than 40 million workers (about 80 percent of the total) had work-related injury insurance. The Ministry of Human Resources and Social Security claimed moreover that 99.73 percent of all new construction projects that began in 2017 were covered (in part or in full) by work-related injury insurance..

Contributions to the work-related injury insurance fund are paid solely by the employer at rates of between 0.5 percent and two percent of payroll; varying according to the health and safety risks of specific industries and locations.

Workers are eligible for work-related injury compensation if they can prove they have an employment relationship with their employer and that the injury sustained is in fact work-related. This is often a far from straightforward process. Once, a work-related injury has been confirmed however, the local authorities assess the level of work disability on a scale from one to ten, with one being the most serious. Workers suffering serious injuries are entitled to considerably more compensation than those with relatively minor injuries. The exact amount of compensation to be paid, and importantly the responsibility for paying, it are largely determined by the Social Insurance Law, the Work-related Injury Insurance Regulations and the Law on the Prevention and Treatment of Occupational Diseases. However, local implementing regulations and selective enforcement of certain provisions means that the actual payout varies considerably from region to region. Moreover, disputes between the employer and employee and the local authorities over the level of compensation and who should pay are a regular occurrence. If an employer fails to pay the required work-related injury insurance contributions, they are legally obliged to cover all expenses themselves. However, in most cases, delinquent employers refuse to pay anything more than basic medical costs for the time the employee is in hospital, if that.

Occupational disease cases are particularly difficult for workers to resolve because the disease often manifests itself after the worker has already left their place of employment, and migrant workers in particular are unlikely to have a contract with that employer anyway. According to the China Labour Statistical Yearbook only 20,812 workers were certified as suffering from an occupational disease in 2016, out of an overall total of 1,036,139 workers who were certified as having a work-related injury that year There are an estimated six million workers in China with the deadly lung disease pneumoconiosis but only about ten percent of them have ever been certified as having an occupational disease. See CLB’s research report Time to Pay the Bill: China’s obligation to the victims of pneumoconiosis for more details.

Maternity insurance

Employees are not required to contribute to the maternity insurance fund, while employers make contributions at rates determined by individual local governments. In the city of Beijing, for example, employers contribute 0.8 percent of total wages paid to eligible employees, in Guangzhou it is one percent of the average monthly wage in the city, while in Chengdu, the rate is 0.6 percent of the total wages of all employees. Maternity insurance covers all maternity-related medical costs, including birth control, prenatal check-ups, delivery and antenatal care, as well as allowances to be paid during maternity leave. According to the Special Provisions on the Protection of Female Employees (女职工劳动保护特别规定), which went into effect on 28 April 2012, women are entitled to 98 days (14 weeks) of maternity leave at a rate equal to at least the average wage at her employer. Some local governments require employers to provide additional allowances for employees earning more than the average wage. Although there is considerable regional variation, China’s maternity leave benefits are basically in line with the standards recommended by the International Labour Organization (ILO).

The number of employees covered by maternity insurance has increased steadily over the last decade to reach 193 million at the end of 2017, according to official figures. Just over 11 million women workers received maternity insurance payments in 2017, with benefits averaging 6,681 yuan per person. Maternity insurance expenses actually exceeded revenue in 2017, perhaps as a result of the changes in family planning policy at the end of 2015 which allowed all couples to have two children. It is likely that the maternity insurance fund will be put under greater pressure in the coming years as a result of the new family planning regulations. As such the government plans to merge the maternity insurance fund with the much more substantial basic medical insurance fund by the end of 2019. This would simplify the contribution process for employers and not place any additional burden on employees, according to proponents of the scheme. Pilot projects were held in 12 cities in 2017, and those jurisdictions reported a 13 percent increase in maternity insurance coverage.

It is doubtful however that the new combined insurance scheme will alter the mindset of employers when it comes hiring young women. Indeed, following the relaxation of family planning rules, there is a good chance that the discriminatory tactics already widely used against prospective female employees will be intensified. Women are often asked about their family plans and sometimes forced to sign illegal contract conditions that require them to take pregnancy tests or guarantee that they will delay pregnancy or not get pregnant all. Many employers find ways to coerce pregnant workers into resigning by making them to work unreasonably long hours or assigning them heavy or dangerous workloads. Other employers simply refuse to grant maternity leave and then fire employees on the grounds of absenteeism. More and more women are now taking legal action against such blatant rights violations. For example, a Beijing shopping mall counter manager, Yin Jing, was awarded 62,237 yuan in compensation by a Beijing appeals court on 5 November 2015 after she had been illegally fired while pregnant. However, for most women, especially low-paid factory workers, going to court or even labour arbitration is simply not an option because they cannot afford the time and money to do so. See Gender Discrimination in China for a more in-depth discussion of this issue.

Housing Fund

The Housing Fund, also known as the Housing Provident Fund, is not officially part of China’s social insurance system: It is administered by the Ministry of Housing and Urban-Rural Development rather than the Ministry of Human Resources and Social Security. However, it is often grouped together with the five official social insurance programs since it functions in a similar manner, with benefits funded through contributions paid by employers and their employees.

The fund was first established in 1999, a time when tens of millions of workers were being laid off from state-owned enterprises (SOEs) across China. The government could no longer rely on SOEs to meet the housing needs of workers so the Housing Fund was promoted as a means by which employees could pay for and maintain their own home. Contributors to the housing fund can apply for preferential rate mortgages, cover housing repair and maintenance costs and get rent subsidies. If unused, the fund can be redeemed upon retirement, and as such it actually functions more as a secondary pension. In addition, recent local amendments have allowed housing funds to be used for non-housing related expenses such urgent or serious medical treatment costs.

The Regulations on the Administration of Housing Funds (住房公积金管理条例) state that employee and employer contribution rates are to be determined by the local government but should not be lower than five percent of the average wage at the enterprise. In Beijing, for example, employers have to contribute 12 percent of the average wage during the previous year and employees contribute 12 percent of their monthly salary. In Shanghai, employers contribute seven percent of the average wage during the previous year and employees contribute seven percent of their average monthly salary in the previous year. In all cases, contributions are made on a monthly basis and are tax-deductible.

Unlike the five social insurance schemes, which have seen regular and substantial increases in coverage over the last decade, the number of workers contributing to the housing fund seems to have fluctuated around the 100 million mark for the last decade. In 2008, there were reportedly 110 million workers in the scheme. The number of participating workers reportedly went down to 91 million in 2011 but was back up to 107 million by the end of August 2014. The total accumulated fund, as of August 2014, was just over seven trillion yuan, according to figures from the Ministry of Housing and Urban-Rural Development. Most of the participants in the scheme are government workers, public servants and professionals in the private sector. Given soaring property prices in China, the housing fund has been seen by the vast majority of low paid workers as irrelevant. Most factory workers for example live in cheap and cramped rented accommodation close to their place of employment, see photograph of factory worker housing in Shenzhen above, and the prospect of owning their own home in the city is a pipedream. That said, some workers, particularly older employees, are now demanding the payment of housing fund contributions in arrears, as well as their social insurance contributions when they are laid off during factory closures etc. This is not necessarily because they want to buy a house but more likely because they want to maximise every benefit possible before retirement.

Unlike the five social insurance schemes, which have seen regular and substantial increases in coverage over the last decade, the number of workers contributing to the housing fund seems to have fluctuated around the 100 million mark for the last decade. In 2008, there were reportedly 110 million workers in the scheme. The number of participating workers reportedly went down to 91 million in 2011 but was back up to 107 million by the end of August 2014. The total accumulated fund, as of August 2014, was just over seven trillion yuan, according to figures from the Ministry of Housing and Urban-Rural Development. Most of the participants in the scheme are government workers, public servants and professionals in the private sector. Given soaring property prices in China, the housing fund has been seen by the vast majority of low paid workers as irrelevant. Most factory workers for example live in cheap and cramped rented accommodation close to their place of employment, see photograph of factory worker housing in Shenzhen above, and the prospect of owning their own home in the city is a pipedream. That said, some workers, particularly older employees, are now demanding the payment of housing fund contributions in arrears, as well as their social insurance contributions when they are laid off during factory closures etc. This is not necessarily because they want to buy a house but more likely because they want to maximise every benefit possible before retirement.

Social insurance and migrant workers

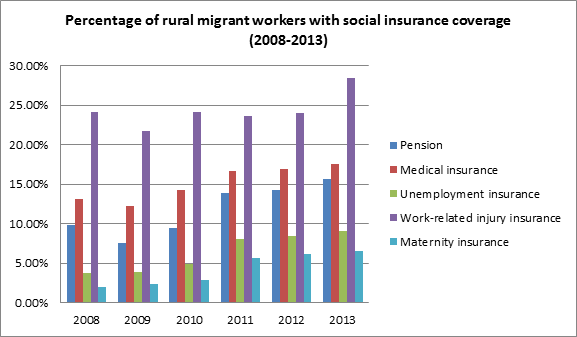

Article 95 of the Social Insurance Law states that “Rural migrant workers in urban areas are to be covered by social insurance in accordance with the provisions of this law” (城务工的农村居民依照本法规定参加社会保险). However, the social insurance system was clearly not designed with migrant workers in mind. It is a highly localised system that assumes employees remain in the same place throughout their working life and retirement. Although more and more migrant workers are now getting social insurance, actual coverage rates are still only about half the national average. The annual survey of migrant workers by the National Bureau of Statistics found that in 2013, only 15.7 percent of the 166 million rural migrant workers employed outside of their home area (外出农民工) had a pension and 17.6 percent had medical insurance. See chart below. Separate figures from the Ministry of Human Resources and Social Security suggested that in 2015, 20 percent of migrant workers had a basic urban pension and 18.7 percent had medical insurance.

Employers have routinely claimed in the past that they have not paid social insurance contributions for migrant workers because the workers themselves are not interested in a pension. They cite the high contribution rates and the lack of transferability of pension accounts as the main reason why migrant workers do not find the system attractive. However, such obfuscation completely ignores the obvious fact that employers have a legal obligation to provide every employee with social insurance. Moreover, the underlying reason migrant workers are unhappy about making pension contributions is not because the rates are too high but rather because their basic salaries are too low and any deductions will have a major impact on their day-to-day living standards.

A key point to note is that the migrant worker population is getting older: More and more workers are middle-aged and already planning for their retirement. The annual survey of migrant workers in China showed that the proportion of workers aged 16 to 30-years-old fell from 42 percent in 2010 to 33 percent in 2015, while the proportion of workers over 40-years-old has jumped from 34 percent in 2010 to 45 percent in 2015. Over the last few years, many of these older workers have been at the forefront of workers’ demands for payment of social insurance. As the migrant workforce continues to age, those demands will only get louder.

Conclusion

After China embarked on its much vaunted economic reform and development program, the government gradually abdicated its authority in labour relations to business interests. As the private sector expanded, employers could unilaterally and arbitrarily determine the pay and working conditions of their employees, keeping wages low and benefits largely non-existent. The national government sought to protect the interests of workers by implementing legislation, such as the 1994 Labour Law and 2008 Labour Contract Law, however local governments either could not or would not enforce the law in the workplace.

Under these circumstances, creating a system where employers are primarily responsible for their employees’ social security was doomed to failure. Employers could often simply ignore their legal obligations and continue with business as usual, often with official connivance. As Reuters reported in February 2015, after the 2008 financial crisis, the central government allowed struggling companies to delay social insurance contributions for up to six months. The policy was never formally rescinded. It was only when the workers themselves started to demand payment of social security (most notably in the 2014 Yue Yuen strike) that employers were forced to comply.

The failure of the Chinese government to enforce the law and create a social security system that covers everyone has not only disadvantaged China’s workers, it has severely hampered the government’s own ability to push ahead with and accomplish other important policy goals.

One of the key policies regularly enunciated by the government over the last few years has been to boost domestic consumption as a means of ensuring more stable and balanced economic growth in the future. Much of China’s consumption power however remains in the hands of the wealthiest one percent and that has led to huge capital outflows rather than increased domestic spending. The majority of workers are still reluctant to spend because, lacking a pension or medical insurance, they tend to set aside what they can in bank savings and other riskier investments in order to try and secure their future and shield themselves from adversity.

The fact that only a fraction of the social insurance contributions that should have been made over the last two decades or so have actually been made, means that the various social insurance funds are under much more pressure than they should be. With China’s rapidly aging population, this is a particular problem for the pension funds and medical insurance funds. As noted above, the government now accepts that it needs to increase the retirement age if there are to be sufficient funds are to cover all expected pension and medical expenses in the future.

However the government is reluctant or unable to force employers to comply with existing social insurance obligations. Rather, the government is trying to reduce the social insurance burden faced by employers and shift the burden of pension and other social insurance contributions onto individual workers, whether they be formally employed or not.

Instead of running away from the problems of employee-based system, the government needs to find a way to accommodate the competing interests of labour and capital in creating a realistic and stable social security system; one that looks after workers during poor health and old age but also helps to create a content and well-paid workforce that in turn can help develop the domestic economy through greater innovation, productivity and consumption of goods and services.

This article was first published in August 2012. It was last updated (in part) in March 2019.