Photo: Jenson / Shutterstock.com

- CLB's Strike Map logged in 2023 a peak in collective actions in the auto industry, the highest number recorded since 2015

- Intense competition and EV transition hit workers of various companies. Worker grievances include layoffs and lack of severance pay, overdue payments, reduced wages and increased workload.

- Just transition initiatives by German and US unions are worth learning.

In 2023, CLB’s strike map recorded 21 collective actions in the automotive manufacturing industry in China – a peak since 2015. 2023 was a year of cut-throat competition among auto OEMs, and parts suppliers were hit as well. Of the 21 collective actions, 10 concern OEMs and 11 concern parts suppliers. This article focuses on OEMs, and “companies” mean OEMs unless otherwise stated. CLB has published another article on grievances of parts supplier workers and how the German Supply Chain Act can be leveraged.

In 2023, while total volume of auto sales and EV sales reached new heights, many lower-tier EV companies closed down or halted production. Their workers protested against overdue payments and lack of severance pay. Some workers in first-tier EV companies also experienced layoffs, and remaining workers complained about increased workload and decreased wages. Meanwhile, traditional auto companies struggled with EV transition, and workers faced layoffs, relocations and reduced wages.

Workers and unions in Germany and the US are also struggling with the EV transition and have highlighted the importance of just transition–greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no one behind. German and US unions have experiences and successes in countering/reducing job loss, ensuring reskilling programs of workers and unionising in new plants to promote quality jobs. These experiences are valuable for official unions in China, who have yet to address the impacts of EV transition on workers.

Workers demand overdue payments as lower-tier EV companies close down in China

At the beginning of 2023, as the EV consumer subsidy program by the central government ended, Tesla lowered the price of popular models and started the price war among auto OEMs in China.

Lower-tier EV companies were especially hard hit. Of the major EV companies in China, only Tesla and BYD had crossed the break-even point and made profits in 2022. They are considered top or first-tier, closely followed by second-tier companies that sold more than 100 thousand EVs per year in 2022-2023 (such as Aion, Li Auto, NIO, Xiaopeng and Leapmotor). The rest are lower-tier companies, many halted production with overdue wages, social insurance payments and severance pay in 2023.

Of the 10 collective actions in auto OEMs in 2023, 4 concern lower-tier EV manufacturers. In June 2023, two thousand workers of Aiways wrote an open letter to the company’s management and shareholders demanding overdue wages and social insurance payments. Workers had not received wages for three months, but no one responded to their concerns and requests. Their phones and messages were ignored, and they were ordered to work from home indefinitely instead of being properly laid off and compensated. They said,

“Our family lives, economic situations and future plans are severely affected…Our hard work should be fairly paid. This is our right. Yet we are abandoned in a bitter situation, feeling disappointed and angry.”

Airways sold only 536 EVs in the first quarter of 2023. Other auto companies that sold even fewer EVs also halted production with workers protesting wages and social insurance arrears.

Reduced wages and heavier workload in first-tier EV companies in China

Labour disputes also occurred at Tesla and BYD, mainly due to reduced wages. In April 2023, Tesla workers in Shanghai posted online that performance pay of frontline workers was unfairly reduced by 2000 yuan. According to workers, management said that the pay cut was due to an accident in February which killed a 31-year-old worker. The government investigative report states that the causes for the accident were the operational errors by two workers (including the dead worker) and that Tesla should improve safety management. Workers were therefore confused and unconvinced that the accident should lead to wage cuts for all frontline workers in the Shanghai factory. Workers also appealed to Elon Musk on Twitter. The incident received wide media attention and Musk promised to look into it. In July 2023, several workers said they had received increases in performance pay for the second quarter though it was unsure how many workers had such an increase.

As for BYD, workers in Changsha, Hunan complained about wage decreases and quit collectively in the second quarter of 2023. According to a media report, a worker said his workload increased by 50% compared to 2022, but his monthly wage decreased by around 1000 yuan. Another media outlet says that the monthly wage of a senior worker in the Changsha factory was only around 3000 yuan, much lower than the national average wage in manufacturing (5850 yuan) or the average wage in Changsha (7131 yuan). Workers were also dissatisfied with management’s way of assigning bonus and financial penalty, as penalties were often higher than bonuses. Analysis says that BYD’s expansion in 2022 led to increased inventory and excess workers in 2023, coupling with rearrangement of production lines among expanded production sites in various cities, workers in Changsha bore the brunt of the changing market.

ICE-focused companies and suppliers struggle with EV transition in China

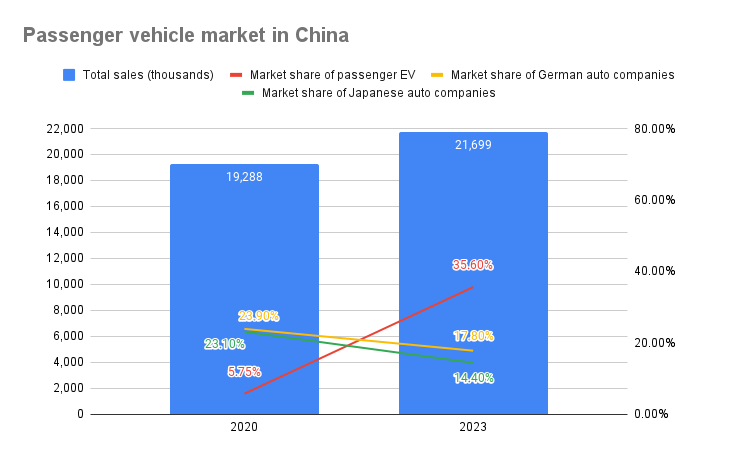

Also struggling in recent years were traditional auto companies with larger proportions of ICE production and sales. They were usually joint ventures (JVs) involving Chinese and foreign companies. The JVs involving German companies (such as FAW-Volkswagen) and Japanese companies (such as GAC-Toyota) were among the most successful, but they lost market share of passenger vehicles in recent years due to slow response to the EV transition. The 2023 price war started by EV companies soon spread to the ICE-focused JVs, who lost further market share and laid off workers.

Data source: CPCA, Caixin

An example is SAIC-Volkswagen, whose automobile sales decreased from around 2 million in 2019 to less than 1.2 million in 2023. Its EV sales were around 75,000 in 2022, lagging behind the second-tier EV companies.

Photo: workers installing car chassis in the Shanghai Volkswagen production plant

Photo credit: Jenson / Shutterstock.com

SAIC-Volkswagen closed one of its ICE producing factories in the Anting, Shanghai production site. The company laid off labour dispatch workers in both production and research departments. Labour dispatch or agency labour is the use of intermediaries to hire workers supposedly for temporary, seasonal, or supplemental work, and they have less protection than formal workers in terms of severance pay and other conditions. However, companies often use labour dispatch beyond these auxiliary purposes to reduce cost and minimise responsibilities. According to workers in the research department, some laid off labour dispatch workers had been in the Anting production site for 7-8 years and could be more familiar with the work than formal workers.

SAIC-Volkswagen’s plan was to reduce ICE production and move it out of Shanghai, and change the Shanghai site into producing EVs. Remaining workers in Shanghai were trained and could work in EV factories and other factories in Shanghai. Some workers still faced reduced shifts, wages and benefits. A worker Shao said he could earn 8000 or even more than 10,000 yuan monthly in the past, but now he could only earn 3000-4000 yuan. There was only 1 shift left in some factories, and it started at 4 am to reduce electricity fees. A worker Zhang said,

“To save electricity, the air conditioning is not turned on even when it is 34 degrees Celsius.”

Parts suppliers were also affected. The Shanghai Automobile Gear Works, which is a subsidiary of SAIC-Volkswagen and supplies transmissions for it, laid off around 300 workers in May 2023 and broke the employment contracts with graduates. The company relied on ICE-related businesses and had fair profitability, but SAIC-Volkswagen decided to restructure it for EV transition.

A similar pattern can be observed in GAC-Toyota. Around 1000 labour dispatch workers/ temporary workers were laid off in July 2023 and remaining workers had reduced hours and wages. Some temporary workers came from the FAW-Volkswagen factory nearby (where there were layoffs), and now they were laid off again. Many could only turn to be temporary workers in courier companies. According to media interviews, remaining workers preferred not to switch to EV factories due to more overtime but lower wages.

Overall employment trends in China

In general, employment in auto manufacturing in China has been above 4 million in recent years and has increased in 2023, but has not reached pre-pandemic levels. EV-related recruitment is the major source of employment growth. In 2023, EV-related recruitment rose by 32%, while the rise in overall recruitment of auto manufacturing was only 5%. BYD’s employment rose from around 200 thousand in 2020 to around 600 thousand in 2022, and more than 20 factories are under construction/just completed construction.

However, there are concerns that automation looms. Though BYD is known to be labour-intensive, its new factories have a higher level of automation. According to the media, Tesla laid off workers and were constructing automation equipment in a battery plant in Shanghai. According to the Energy Foundation’s report on China’s auto employment prospects, in 2020 for every production of 10,000 ICEs, 143 researchers and 1052 production workers were involved. The numbers for EVs were 1156 researchers and 3709 production workers, and the report forecasts that these numbers will fall below that of ICEs as the industry matures.

Workers and trade unions have to be prepared for both the transition to EV jobs among various companies and the absolute reduction of auto manufacturing jobs. As mentioned, workers could face layoffs in ICE and EV companies, with problems of overdue payments, inadequate compensation, reduced wages and overtime, relocations and loss of quality and formal employment. While the EV transition is important in tackling climate change, worker employment and labour rights have to be protected for a just transition. The official trade unions in China have yet to address these problems and make long-term plans. The experiences of German and U.S. auto workers and unions can serve as reference/examples.

German and US workers’ concerns about the EV transition

In Germany and the United States, unions voice concerns about job loss with the EV transition. IG Metall in Germany and UAW in the US are concerned that as EV powertrains are mechanically simpler than ICE powertrains and have fewer moving parts, the EV transition will possibly lead to job loss. Companies also stated that product simplification that came with EVs could lead to 30% reduction in labour hours per unit. Workers’ concerns deepened with the prospect of automation and assembly line simplification.

A 2023 thesis by Zafer Ornek identified three major groups of auto workers who would likely lose jobs in the EV transition in Germany. They are the temporary/agency workers (temps) in large auto companies, skilled workers specialised in ICE production, and workers in small and medium sized enterprises (SMEs, usually indirect suppliers of large auto companies). The temps would likely be hit first, as in previous business cycles. Older skilled workers that have little prospect to be retrained would face early retirement. SMEs have been excluded from the R&D initiatives of the large automakers, who have larger bargaining power and can shift risks and costs to the SMEs. Therefore, SMEs have less capacity to adapt to and thrive with the EV transition. Also, temps and SME workers are usually not unionised and are thus more vulnerable.

Similar concerns are presented in UAW’s EV report, which urges companies and governments to support retraining of workers and domestic SMEs and promote unionisation. UAW has also represented temps and shortened the time for temps to become permanent workers in the 2023 collective bargaining (See Labor Notes’ report).

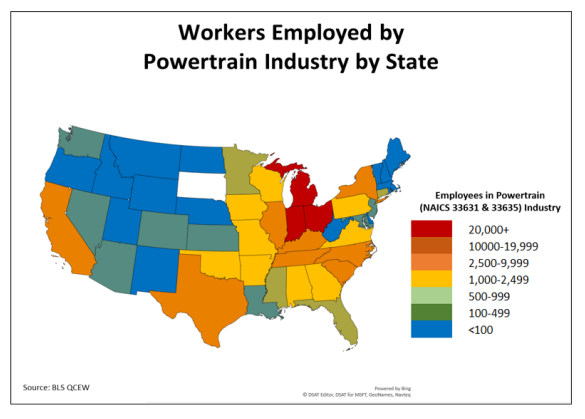

Unions are also concerned about the locations and job quality of the EV production, especially battery plants. The UAW report states that powertrain employment is concentrated in midwest regions of the US, where unions have a stronger presence. Meanwhile, many battery plants are located in the south where unions are less welcomed. Also, the “Big 3” auto companies have refused to include their joint-venture battery plants in master agreements with UAW, claiming that the plants are separate legal entities.

Photo source: Report by UAW Research Department

IG Metall’s president Jörg Hofmann also warned against potential job losses in Germany due to insufficient public and private investment in existing auto plants, and that nobody is sure where, and under what conditions, new jobs will be created. In addition, both U.S. and German unions are concerned that battery plants would be outsourced to the leading companies in China, Japan and South Korea.

Unions call for just transition as EV transition proceeds

U.S. and German unions actively respond to the EV transition with the call for just transition and efforts to protect workers. The first is private and public investment in renovating existing plants as well as new plants locally, together with reskilling and education of workers. The second is unionisation of the EV/ battery plants, including those in less union-friendly regions, to ensure and promote quality union jobs and to increase the bargaining power of unions in face of large auto companies.

In the UAW’s 2023 collective bargaining, the union won the right to strike over product decisions, investment and plant closures in the Big 3 companies. The UAW also made Stellantis agree to reopen the Belvidere Assembly plant in Illinois, whose closure devastated workers and local communities. Stellantis will also add 1,000 jobs at a new battery plant there. UAW also made the Big 3 companies include some battery plant workers in master agreements and raise the pay and conditions of workers there. UAW is also determined to direct the momentum of the recent contract gains to unionise plants in the south, including those of foreign companies and anti-union US companies like Tesla.

Photo: UAW president leading a march in the 2023 strike and collective bargaining

Photo credit: Luis Yanez / Shutterstock.com

In Germany, trade unions and works councils negotiated employment guarantees and reskilling programs with large companies such as Daimler. In 2020, Daimler announced reducing several thousands of jobs in Germany. However, an employment guarantee was negotiated until 2029. The company has also pledged to invest 35 billion euros in German plants (including for electric motor production), and it was agreed that issues of sourcing components inhouse or externally would be negotiated with the works councils. Also, reskilling programs are ongoing in Daimler, and around 20,000 employees received training in the field of electromobility in 2020.

The experiences of the German and U.S. trade unions are valuable for official unions in China, who have yet to address the impacts of EV transition on general and specific types of workers. As the EV transition proceeds with greater competition and changing economic conditions, workers likely will face further layoffs, relocations, overdue payments, inadequate compensation and erosion of job quality and stability. Union support in protecting jobs, reskilling workers, enhancing job quality and involving workers in the decision making of productions are crucial in actualising just transition. Moreover, as a new wave of supply chain due diligence legislation is enacted or pending in Europe, unions and civil society could make use of such legal tools to demand downstream automakers take up responsibility to address and remedy labour violations upstream.

This article is a collaboration between China Labour Bulletin and the SOAS student placement program, with contributions from Farida Mohamed Hafeez.